Mortgage Meltdown 2008 Could It Happen Again

Overall, the real estate market is one of the few that has failed to recover from the 2022 collapse in stock prices. While home sales and prices are strong, there are over 600K seriously delinquent mortgages and over 2.5M active forbearance plans. As described in-depth in "KBWY: Value Trap As REITs Face Permanent Structural Changes", the commercial property market is a mess with many landlords struggling with eviction moratoriums and a collapse in demand for retail and now office properties.

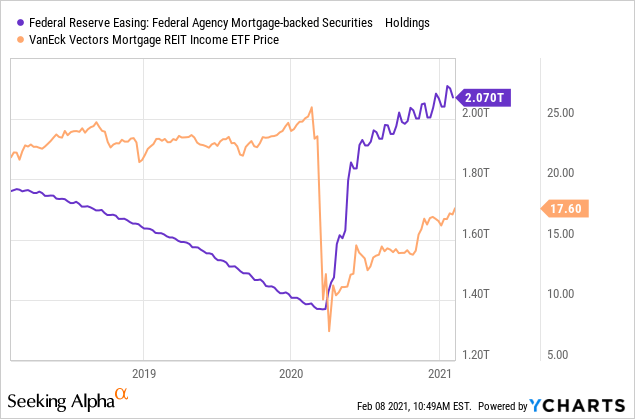

Put simply, the property market is only surviving due to the extreme decline in mortgage rates last year which artificially boosted demand and fiscal stability. This was completed through the Federal Reserve's aggressive mortgage-backed-security purchase program which has pushed mortgage rates to all-time-lows. While this has been an encouraging factor, long-term rates have been rising over the past few months and the mortgage market will likely follow suit.

In April, the millions of U.S homeowners in forbearance must exit their plan, though Biden may see this date pushed back to September. This will most likely lead to a surge in non-performing mortgages on the bank and mortgage-REIT balance sheets. It will also cause Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC) to incur a significant liquidity drawdown as they are guaranteeing many of these mortgages. Properties are expensive again and many indebted homeowners are struggling to make payments. Quite frankly, it is possible we see a repeat of the 2007-2010 scenario in the mortgage market.

In my view, this could create significant volatility for mortgage REITs as seen in the VanEck mortgage REIT ETF (NYSEARCA:MORT). To review, a mortgage REIT is a company that borrows money (typically near LIBOR) and purchases mortgages. Essentially, mREITs are banks that focus exclusively on mortgages and typically operate at high leverage and pay very high dividends. Many of these mortgages are guaranteed by Fannie Mae and Freddie Mac, but this "guarantee" is far from guaranteed since they may not be bailed out again despite conservatorship.

A Look at mREITs Post-COVID

Currently, MORT has an attractive TTM dividend yield of 7.8%, however, it has had to cut its payments over the past year due to a decline in cash-flows in its holdings. Many mREITs were forced to sell their assets during the crash last year which caused a liquidity-run on residential mortgage-backed securities - the cornerstone assets of many top mREITs. The situation was eventually saved by the Federal Reserve which purchased over $600B in mortgages from the nearly bankrupt mREITs and banks.

See below:

Data by YCharts

Data by YChartsThe situation over the past year has been eerily similar to that of 2007-2008. The key difference is that the Federal Reserve and U.S lawmakers are a bit more seasoned in their methods of staving off mortgage crises.

While the liquidity front is nearly guaranteed by the Fed, the core issue of homeowners not making payments remains. Despite progress, still, around 5% of mortgagors are behind by four or more payments. This level could increase as unemployment benefits end for many, particularly if the jobs market remains weak.

In my view, while the economy may continue to rebound, it will not return to what it was. The habits, beliefs, desires, and interests of many consumers have shifted. It is difficult to say exactly what economic changes this will bring, but it is likely that fact that many jobs and industries will become less viable due to a permanent decline in demand. Eventually, new jobs and industries will arise as always. However, investors may want to brace themselves for an economic transitional period which could lead to a multi-year recession/depression as people find the jobs they left to no longer exist or the business they returned to is no longer viable.

Can the Federal Reserve Save the Market?

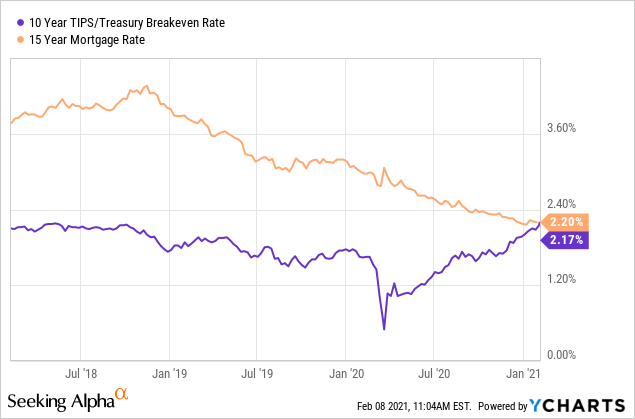

Given the general views of most majority lawmakers and the President, efforts will likely be made to keep people from being evicted from their homes. As has been the case, the Federal Reserve's liquidity supply will be used. However, this liquidity supply is limited by rising inflation expectations. If inflation continues to rise at its current pace, the Fed will likely be forced to cut Q.E and potentially raise rates even if it is bad for the economy in order to stop the risk of hyperinflation.

Today, mortgage rates are still declining but they are now at essentially the same level as inflation-expectations. This has never been the case in the recorded history of mortgage rates in the U.S. See below:

Data by YCharts

Data by YChartsThis is a strong sign that the Fed's supposed fire-power to provide "limitless" liquidity to the mortgage market may be fading when it is needed the most. If the Fed becomes unable to print more mortgage money, mortgage REITs may be forced to take the fall as Fannie and Freddie are, in my view, entirely dependent on this governmental support to guarantee the dominant mortgages held in most mREITs.

Given this, it is entirely possible that we see a repeat mortgage liquidity crisis like the one in 2008 which caused financial turmoil for mREITs. Back then, the Federal Reserve's ability to support the market was much stronger. The Fed was only then learning its true capabilities through Q.E. Today, I believe its capabilities may be dangerously overexaggerated which could spell trouble for mortgage REITs and banks.

The Bullish Case

The base-case view I hold for mortgage REITs is bearish. It is difficult, if not impossible, to predict how bearish since it depends on the decisions of a handful of individuals. However, I do not believe that the current administration or majority leadership will take issue with letting private businesses like mREITs fail in order to stop mass evictions. Put simply, if the Federal Reserve stops supporting the mortgage-backed-security market then many mREITs could go bankrupt under the weight of their extreme leverage.

That said, it is still possible for the market to recover. Most mortgage-REITs are very cheap with MORT trading at a weighted-average price-to-book ratio of 0.93X which means many are likely trading below their net-asset-value. The 7.8% dividend yield is also attractive and its yield could rise if mortgage-REITs' dividends return to pre-COVID levels.

In my opinion, if inflation expectations stop rising and decline slightly, then the Federal Reserve will have sufficient capabilities to effectively bail-out the mortgage market. It is also possible that my view that the permanent economic changes resulting from COVID will lead to prolonged high unemployment is wrong. If so, we can expect the millions of delinquent and in-forbearance mortgagors to make missed payments and relieve Fannie and Freddie from the risk of a liquidity crisis.

Either of those two scenarios would be bullish for MORT and its constituents. The spread between mortgage rates and short-term borrowing rates will also likely rise over the coming year which may boost the profitability of many mortgage REITs and encourage dividend growth.

The Bottom Line

Overall, I believe that MORT and its constituents are best avoided. They have risen dramatically in recent months and, while some value may still remain, I do not believe their valuation discounts the risk of a liquidity crisis. Many homeowners are not making payments and sometime this year (be it April or later) their obligations will be realized.

While Fannie and Freddie guarantee these mortgages, mREITs may still assume the risk if the Fed cannot create enough liquidity to effectively bail-out Fannie and Freddie once again. Given the fact that the core issues in the U.S mortgage market are just as bad if not worse than they were in 2008, some lawmakers may prefer to simply let private lenders fail as opposed to "kicking the can down the road" yet again.

This situation depends on joblessness remaining higher for longer and inflation expectations continuing to rise. I believe we are headed for a multi-year period of "stagflation" which would make this a significant risk. However, it is also possible that we see a return to normal and a reversal of inflation which would save mortgage REITs. Due to this, I would not short MORT for the time being, but I would also not buy it. The high dividend yield may be enticing, but MORT could decline 50-80%+ if there is another mortgage crisis.

This article was written by

Harrison is a financial analyst who has been writing on Seeking Alpha since 2022 and has closely followed the market for over a decade. He has professional experience in the private equity, real estate, and economic research industry. Harrison also has an academic background in financial econometrics, economic forecasting, and global monetary economics. His promise to readers is that he will tell the truth as best he can see it, with no sugar coating and no hype - even if his view disagrees with the popular narrative (which it usually does these days).

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: https://seekingalpha.com/article/4404381-mort-2008-like-mortgage-crisis-is-not-off-table

0 Response to "Mortgage Meltdown 2008 Could It Happen Again"

Postar um comentário